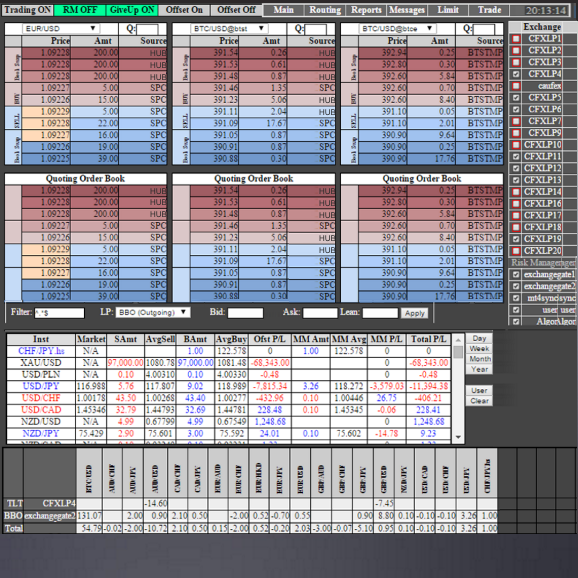

Besides offering 100% Transparency Standards represented by CFX S.M.A.R.T. HUBECN

with Equal Right Opportunity Infrastructure offered to all Institutional and Individual Members, CFX Prime Clearing is offering all turn-key Liquidity, Operational & Technology solutions to all Institutional and Individual Members.

Low Budget FX Broker Solution!

FX Firms Welcome:

1.Pre-launch Order

2.Customized Broker

3.Dedicated BBO Engine

4.Risk-Management

A/B/C (A & B) Books

5.Unique Deep Liquidity

6.Customized Liquidity

7.MT4 FIX Bridge

0% programming required to Own Your FX & Crypto ECN!

Build your Own FX & Bitcoin ECN

1.You have LP Accounts

w/multiple LPs & APIs open

Enter API info into fields online &

Your ECN is ready!

2.You don’t have LP Accounts

a. Choose LPs from the list

b. Open accounts with LPs

c. Obtain FIX API credentials

d. Enter API info online &

Your ECN is ready!

Unique Tools for MT4 Server

Take advantage of Exchange

Low Cost MT4 Solution

1.Official MT4 White Label Registered under your Entity Name Includes:

a. MT4 FIX Bridge w/Limit Order Routing Capabilities

b. BBO Risk Management with real-time LP connectivity management capabilities

c. Pre-build Deep Liquidity

d. Add Customized Liquidity

2.Exchange Franchise CFX ECN White Label

LOWEST PRICE!

a. MT4 FIX Bridge w/Limit Order Routing Capabilities

b. BBO Risk Management with real-time LP connectivity management capabilities

c. Pre-build Deep Liquidity

Your Gateway to Unique Liquidity!

Take advantage of Exchange Electronic Liquidity HUBs

1.Best Bid & Offer BBO Engine

2.Limit Orders routed to BBO

3.Order Matching Engine

4.Premier customized turn-key

5.Customized liquidity solution Available in accordance to Customer’s business model

6.Low Cost additional FIX API Connectivity AVAILABLE!

Request to Own Your Exchange

Low Cost Exchange Solution

1.Types of Exchanges to Order:

a. Commodities Exchange

b. Derivatives Exchange

c. Foreign Exchange

d. Crypto BTC Exchange

2.Simplest Order Process:

a. Compile Your Idea

b. Prepare your Business Model

c. Order a Free Consultation

d. Execute an NDA

e. Supply with Paperwork including Tradable Instrument Specs

Setting Up Your Own Exchange

1. We’ll prepare the Agreement

2. From this point Minimum time of 72 hours is required for allocating hosting facility, Infrastructure, setting up your tradable Instruments & QA testing

3. We’ll launch Pilot/Test Instance after the initial deposit is made

4. We’ll launch Production version after you accept Pilot Instance